Sales And Use Tax Rate Kentucky . kentucky’s sales and use tax rate is six percent (6%). kentucky sales and use tax rate in 2024 is 6%. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Kentucky does not have additional sales taxes imposed by a city or county. Gross receipts exemption for taxable services. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. Legislative changes from house bill 8. Use our calculator to determine your exact sales tax rate. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including.

from www.formsbank.com

you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. Legislative changes from house bill 8. kentucky sales and use tax rate in 2024 is 6%. Use our calculator to determine your exact sales tax rate. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Kentucky does not have additional sales taxes imposed by a city or county. kentucky’s sales and use tax rate is six percent (6%). learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. Gross receipts exemption for taxable services. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including.

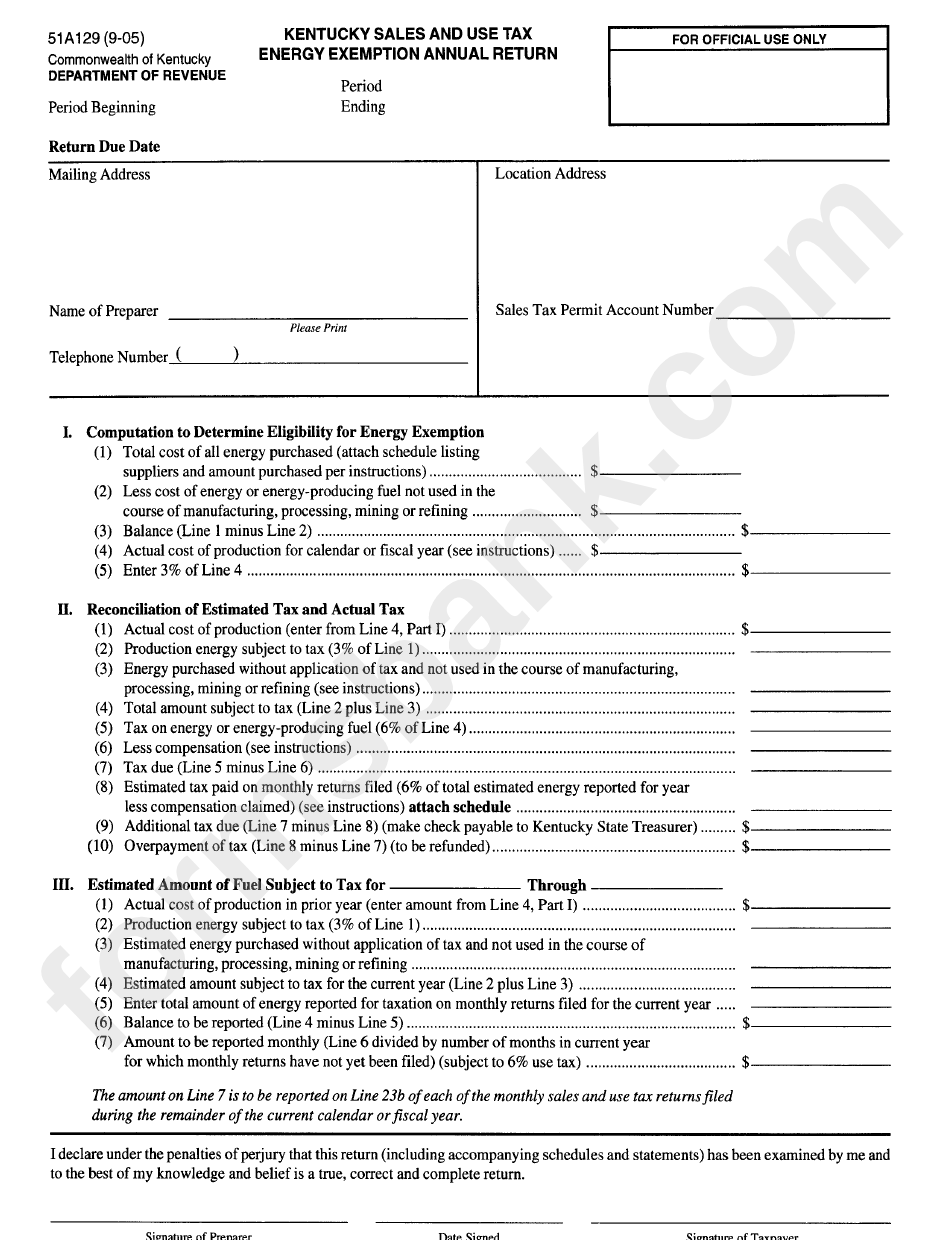

Kentucky Sales And Use Tax Energy Exemption Annual Return Form

Sales And Use Tax Rate Kentucky 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including. Gross receipts exemption for taxable services. Kentucky does not have additional sales taxes imposed by a city or county. Legislative changes from house bill 8. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. kentucky sales and use tax rate in 2024 is 6%. kentucky’s sales and use tax rate is six percent (6%). Use our calculator to determine your exact sales tax rate.

From albertinewpier.pages.dev

Sales Tax For All States 2024 Mamie Kayley Sales And Use Tax Rate Kentucky learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. Use our calculator to determine your exact sales tax rate. Kentucky does not have additional sales taxes imposed by a. Sales And Use Tax Rate Kentucky.

From www.formsbank.com

Kentucky Sales And Use Tax Energy Exemption Annual Return Form Sales And Use Tax Rate Kentucky Use our calculator to determine your exact sales tax rate. kentucky’s sales and use tax rate is six percent (6%). 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. you can use our kentucky sales tax calculator to look up sales tax. Sales And Use Tax Rate Kentucky.

From hxejymsle.blob.core.windows.net

Columbus Ohio Tax Reciprocity at Josh Hollis blog Sales And Use Tax Rate Kentucky you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. Gross receipts exemption for taxable services. kentucky sales and use tax rate in 2024 is 6%. Use our calculator to determine your exact sales tax rate. Kentucky does not have additional sales taxes imposed by a city. Sales And Use Tax Rate Kentucky.

From stepbystepbusiness.com

Kentucky Sales Tax Calculator Sales And Use Tax Rate Kentucky 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Kentucky does not have additional sales taxes imposed by a city or county. Legislative changes from house bill 8. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax. Sales And Use Tax Rate Kentucky.

From kylieallan.pages.dev

Ohio State Sales Tax 2025 Calendar Kylie Allan Sales And Use Tax Rate Kentucky kentucky sales and use tax rate in 2024 is 6%. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. kentucky’s sales and use tax. Sales And Use Tax Rate Kentucky.

From hxeujnjgj.blob.core.windows.net

Kentucky House Bill 8 Sales Tax at Janice Tally blog Sales And Use Tax Rate Kentucky Gross receipts exemption for taxable services. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. kentucky’s sales and use tax rate is six percent (6%). kentucky sales and use tax rate in 2024 is 6%. you can use our kentucky sales. Sales And Use Tax Rate Kentucky.

From estabneilla.pages.dev

Kentucky Farm Tax Exempt Form 2025 Lola Lillian Sales And Use Tax Rate Kentucky Legislative changes from house bill 8. Gross receipts exemption for taxable services. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. kentucky sales. Sales And Use Tax Rate Kentucky.

From gioupmuos.blob.core.windows.net

Tax Brackets For Kentucky at Dylan Ayala blog Sales And Use Tax Rate Kentucky kentucky’s sales and use tax rate is six percent (6%). Gross receipts exemption for taxable services. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. Kentucky does not have additional sales taxes imposed by a city or county. Legislative changes from house bill 8. you can use our kentucky. Sales And Use Tax Rate Kentucky.

From www.inkl.com

10 States With the Lowest Sales Tax Sales And Use Tax Rate Kentucky the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including. kentucky sales and use tax rate in 2024 is 6%. Gross receipts exemption for taxable services. Legislative changes from house bill 8. Kentucky does not have additional sales taxes imposed by a city or county. . Sales And Use Tax Rate Kentucky.

From hxeothesx.blob.core.windows.net

Marshall County Ky Real Estate Taxes at Patricia Vickery blog Sales And Use Tax Rate Kentucky kentucky sales and use tax rate in 2024 is 6%. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. Kentucky does not have additional sales taxes imposed by a city or county. Gross receipts exemption for taxable services. you can use our kentucky sales tax calculator to look up. Sales And Use Tax Rate Kentucky.

From www.stsw.com

How State Taxes Are Paid Matters Stevens and Sweet Financial Sales And Use Tax Rate Kentucky Gross receipts exemption for taxable services. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. Kentucky does not have additional sales taxes imposed by a city or county. . Sales And Use Tax Rate Kentucky.

From printableranchergirllj.z22.web.core.windows.net

State Sales Tax Rate 2023 Sales And Use Tax Rate Kentucky Gross receipts exemption for taxable services. kentucky’s sales and use tax rate is six percent (6%). 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Kentucky does not have additional sales taxes imposed by a city or county. kentucky sales and use. Sales And Use Tax Rate Kentucky.

From free-printablemap.com

Sales Tax By State Map Printable Map Sales And Use Tax Rate Kentucky 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. kentucky’s sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city or county. Use our calculator to determine your exact sales tax rate. Legislative. Sales And Use Tax Rate Kentucky.

From ar.inspiredpencil.com

Sales Tax By State Chart Sales And Use Tax Rate Kentucky Kentucky does not have additional sales taxes imposed by a city or county. the kentucky sales tax handbook provides everything you need to understand the kentucky sales tax as a consumer or business owner, including. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. Sales And Use Tax Rate Kentucky.

From exokbnkrm.blob.core.windows.net

Ct Luxury Car Sales Tax at Alishia Barrett blog Sales And Use Tax Rate Kentucky Kentucky does not have additional sales taxes imposed by a city or county. you can use our kentucky sales tax calculator to look up sales tax rates in kentucky by address / zip code. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a.. Sales And Use Tax Rate Kentucky.

From www.reddit.com

[OC] Effective Sales Tax Rates in dataisbeautiful Sales And Use Tax Rate Kentucky Use our calculator to determine your exact sales tax rate. learn how to prepare your business to manage kentucky sales and use tax registration, collection, and filing. Gross receipts exemption for taxable services. kentucky’s sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city or county. 803. Sales And Use Tax Rate Kentucky.

From giopvfygc.blob.core.windows.net

City Of Crestview Hills Ky Property Taxes at Philip Fraley blog Sales And Use Tax Rate Kentucky kentucky’s sales and use tax rate is six percent (6%). Use our calculator to determine your exact sales tax rate. kentucky sales and use tax rate in 2024 is 6%. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Legislative changes from. Sales And Use Tax Rate Kentucky.

From teressarobles.blogspot.com

how much taxes are taken out of a paycheck in ky Teressa Robles Sales And Use Tax Rate Kentucky kentucky’s sales and use tax rate is six percent (6%). Legislative changes from house bill 8. 803 rows kentucky has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to n/a. Kentucky does not have additional sales taxes imposed by a city or county. the kentucky sales tax. Sales And Use Tax Rate Kentucky.